Unlocking the Ideal Trading Windowsin Forex Markets

Discover the optimal trading hours and capitalize on market opportunities with ScoreCM's expert guidance.

Watch Trading Hours

Intrument

Trading Hours

EURUSD, GBPUSD, USDJPY, USDCAD etc.

00:00 - 23:59 (Weekdays)

USDRUB

0:10 - 21:00 (Weekdays)

Intrument

Trading Hours

DOW30

01:00 - 23:15, 23:30 - 23:59 (Weekdays)

NAS100

01:00 - 23:15, 23:30 - 23:59 (Weekdays)

SPX500

01:00 - 23:15, 23:30 - 23:59 (Weekdays)

UK100

03:00 - 23:00 (Weekdays)

GER40

03:15 - 23:00 (Weekdays)

GER40

03:15 - 23:00 (Weekdays)

EU50

03:15 - 23:00 (Weekdays)

FRA40

09:00 - 23:00 (Weekdays)

ESP35

09:00 - 21:00 (Weekdays)

ITA40

09:05 - 23:55 (Weekdays)

Intrument

Trading Hours

USOIL

01:00 - 23:59 (Weekdays)

UKOIL

03:00 - 23:59 (Weekdays)

NATGAS

01:00 - 23:59 (Weekdays)

Intrument

Trading Hours

BTCUSD, ETHUSD, XRPUSD, BCHUSD, BITUSD ,LTCUSD etc

7 / 24

Intrument

Trading Hours

XAU, XAG, XPD, XPT

01:00 - 23:59 (Weekdays)

COPPER

03:00 - 23:59 (Weekdays)

Trading hours may change on public holidays and due to unexpected market conditions, such as volatility. For the latest information on trading hours for your selected instruments, refer to your MT5 terminal.

Start trading now!

Spreads lower than ever! START trade with a trusted broker!

Trading Hours FAQs

Trading hours play a crucial role in determining the availability and liquidity of financial instruments, affecting trading strategies, execution speeds, and overall market dynamics.

- Volatility: Market volatility tends to vary throughout trading hours, with higher levels often observed during opening and closing times when trading activity is typically elevated.

- Liquidity: Liquidity levels can fluctuate during different trading sessions, impacting the ease of buying and selling assets. Traders should consider liquidity conditions when planning their trading activities to avoid potential slippage or difficulty executing orders.

- Overnight Positions: Understanding trading hours is particularly important for traders holding positions overnight, as market conditions can change significantly during non-trading hours, potentially affecting the value of their investments.

Time zone differences can impact trading hours, especially for traders operating in different regions or countries.

- Overlap Periods: Overlap periods occur when multiple financial markets are open simultaneously due to time zone differences. These periods typically result in increased trading activity and liquidity as traders from different regions engage in transactions.

- Global Trading: The rise of electronic trading platforms has facilitated global trading, allowing investors to participate in markets around the clock. However, traders need to be mindful of time zone differences and market hours to effectively manage their positions and exposure.

- Daylight Saving Time: Daylight Saving Time changes can further complicate trading hours, as certain regions may adjust their clocks differently. Traders should be aware of these changes to avoid confusion and ensure accurate timing of trades.

Trading hours can vary significantly depending on the financial market, geographical location, and the type of asset being traded.

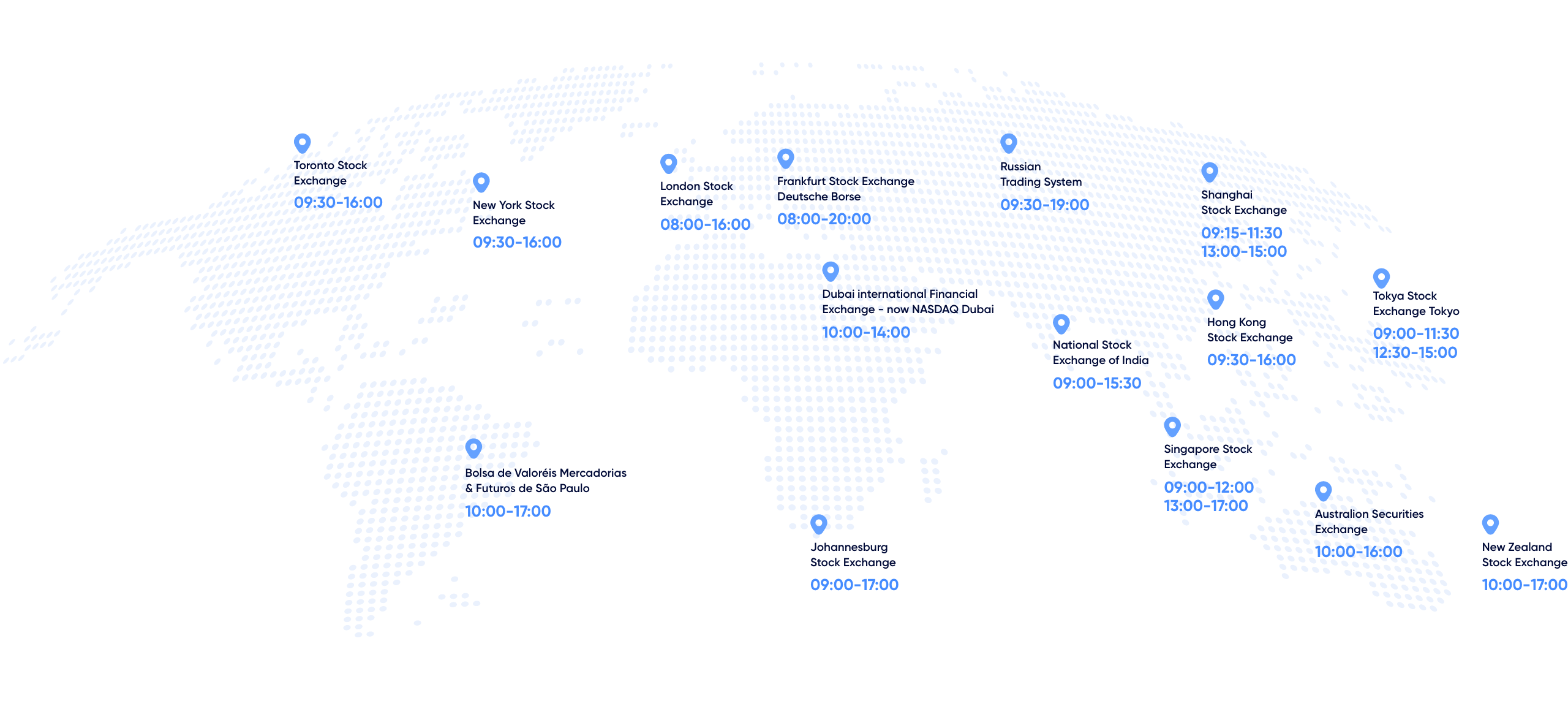

- Stock Markets: Stock markets typically operate during regular business hours, which may vary by country and exchange. Some stock exchanges also offer extended trading hours for certain securities.

- Forex Market: The forex market operates 24 hours a day, five days a week, due to its global nature. However, trading activity may vary depending on the session (Asian, European, or North American), with peak trading hours occurring when multiple sessions overlap.

- Commodity Markets: Commodity markets have specific trading hours determined by the exchange on which the commodities are traded. These hours may vary depending on the commodity and the exchange's operating hours.

If you have more questions visit FAQ Page

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. It is important to fully understand the risks involved and seek independent advice if necessary. You should carefully consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money. The value of your investment may go down as well as up.

Please review our Legal Documents to understand the risks involved before you invest. See your rights and responsibilities as a retail client.

Please review our Legal Documents to understand the risks involved before you invest. See your rights and responsibilities as a retail client.

For help, visit our